Excel modeling

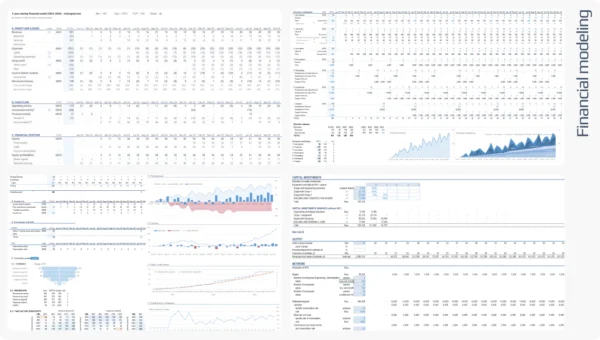

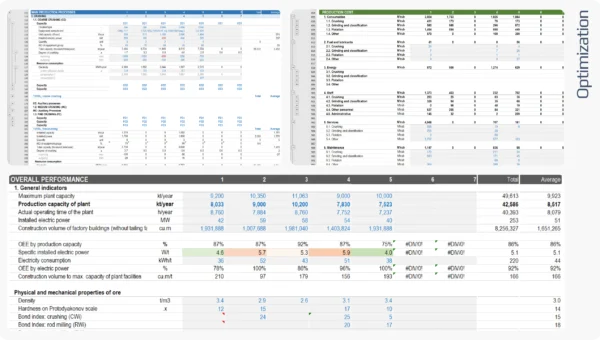

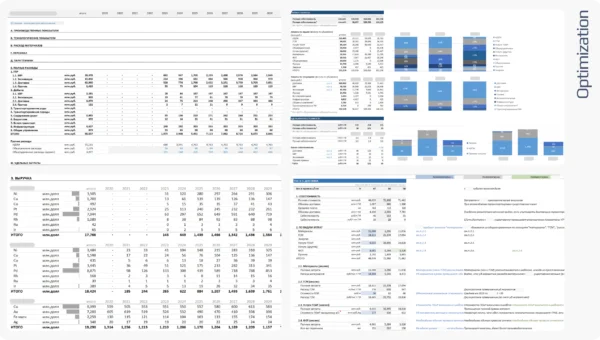

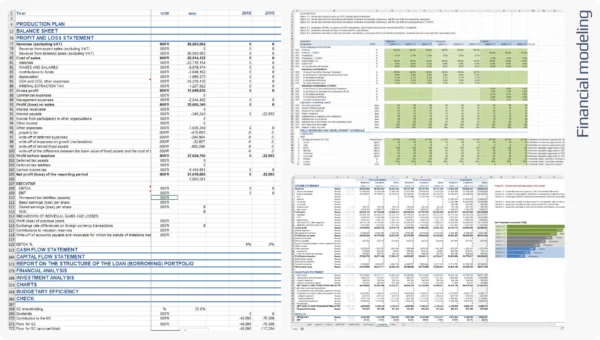

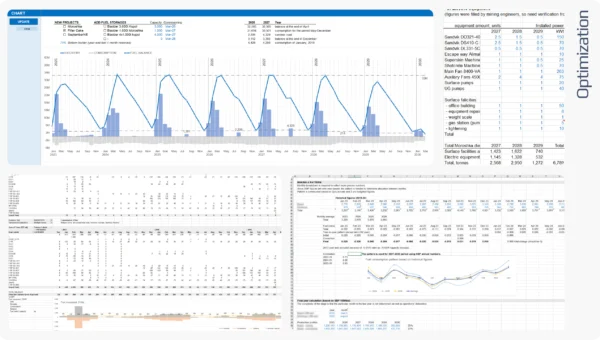

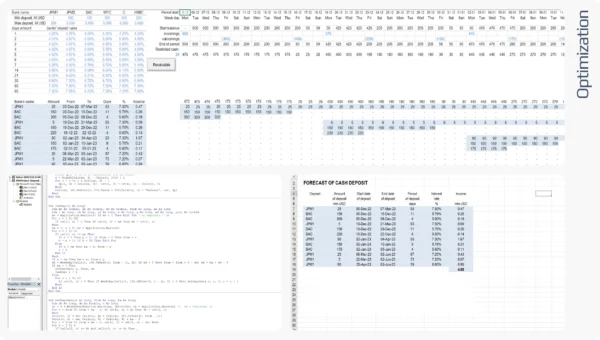

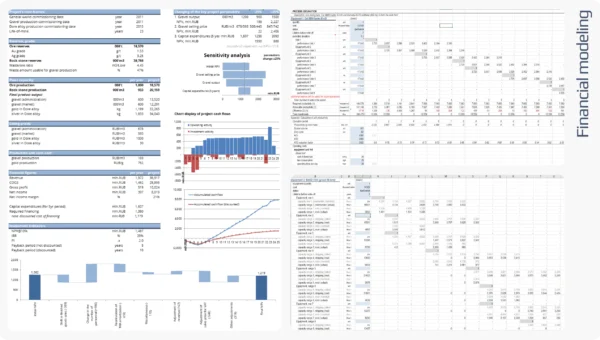

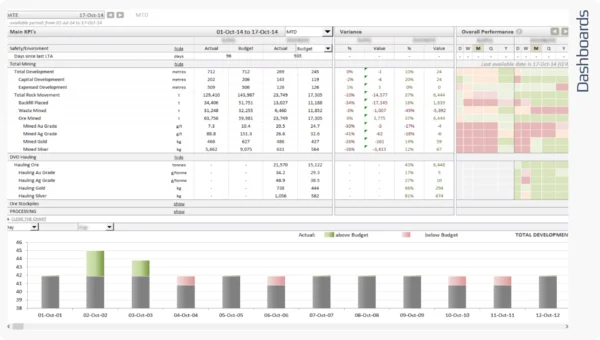

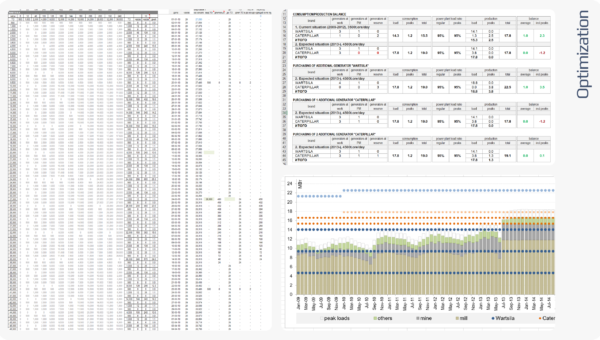

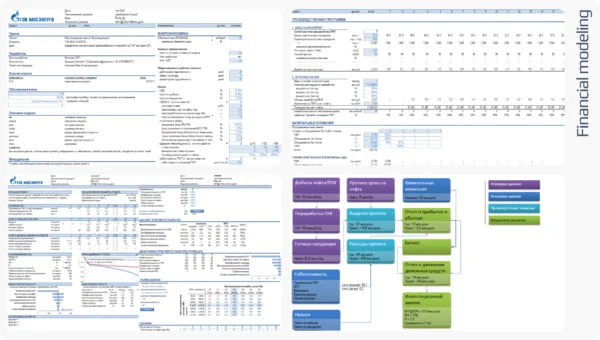

With our extensive corporate experience, we can deliver solution for any problem that required technical or financial calculations: input tables, charts, various financial models (budgets, evaluations, startups, LBO, 3-statements), technical calculations, and many more.

Embedded programming language (VBA) helps you to go above usual Excel capabilities.

PowerQuery can perform all simple DWH and ETL tasks: connect to database, clear and transform it, add calculated columns, keep info as data model. We can create summary dashboards right in the Excel workbook, or tune-in PowerBI solution.

We initiate the project by clearly defining the scope of work with the client and reaching a mutual agreement on the cost associated with the project.

[Contract signing, 50% advanced payment]

Once the scope and cost are established, we sign NDA and request the client to provide us with all the necessary materials, data, and information required to commence the work.

Using the provided materials, we develop the required calculations in Excel, tailoring them to the client's specific wishes and specifications.

We present the completed calculations to the client for their review and approval. Any necessary adjustments or modifications requested by the client are implemented promptly.

After incorporating the requested adjustments, we proceed to finalize the project, ensuring all calculations meet the client's requirements and expectations. The client's final approval is sought before moving forward.

In the last step, we transfer the sources of the Excel calculations to the client, adhering to the agreed-upon method of transfer. This ensures that the client possesses the necessary resources for future use or further customization.

[Work completion signing, 50% final payment]

- min project is $6,000

- time&material contract is available

- for complex projects – MVP every 2 weeks

- min project is $6,000